Karnataka's Temple Tax Legislation: Examining Claims, Counterclaims, and the Facts

The Karnataka Hindu Religious Institutions and Charitable Endowments Act, 1997, is legislation enacted by the state government of Karnataka to regulate and manage Hindu religious institutions and charitable endowments within the state. The primary objective of this act is to ensure proper administration, governance, and utilization of funds and assets associated with Hindu temples, mutts, and religious trusts.

Key provisions of the Karnataka Hindu Religious Institutions and Charitable Endowments Act include:

1. Registration of Institutions: The act mandates the registration of Hindu religious institutions, including temples, mutts, and trusts, with the state government. Institutions must comply with the rules and regulations prescribed by the authorities.

2. Appointment of Trustees: The act specifies the process for appointing trustees to manage the affairs of registered institutions. Trustees are responsible for overseeing the administration, finances, and activities of the institution.

3. Administration of Funds and Assets: The act regulates the management of funds, properties, and assets belonging to registered institutions. It outlines guidelines for the utilization of income generated from endowments, donations, and offerings.

4. Maintenance of Accounts: Registered institutions are required to maintain accurate accounts and records of their financial transactions, including income, expenditure, and assets. They must submit annual reports and financial statements to the authorities for review and audit.

5. Protection of Endowments: The act aims to safeguard the interests of donors and devotees by ensuring that endowments and offerings made to religious institutions are used for the intended purposes. Any misappropriation or misuse of endowment funds is strictly prohibited.

6. Regulation of Religious Practices: While respecting the religious customs and traditions of Hindu institutions, the act empowers the government to regulate certain practices to prevent exploitation, discrimination, or abuse of devotees.

7. Appointment of Executive Officers: The state government may appoint executive officers or administrators to oversee the day-to-day operations of registered institutions. These officers are responsible for implementing government policies and directives.

8. Dispute Resolution: The act provides mechanisms for resolving disputes related to the administration, management, or ownership of religious institutions and endowments. Disputes may be adjudicated by the authorities or referred to civil courts for resolution.

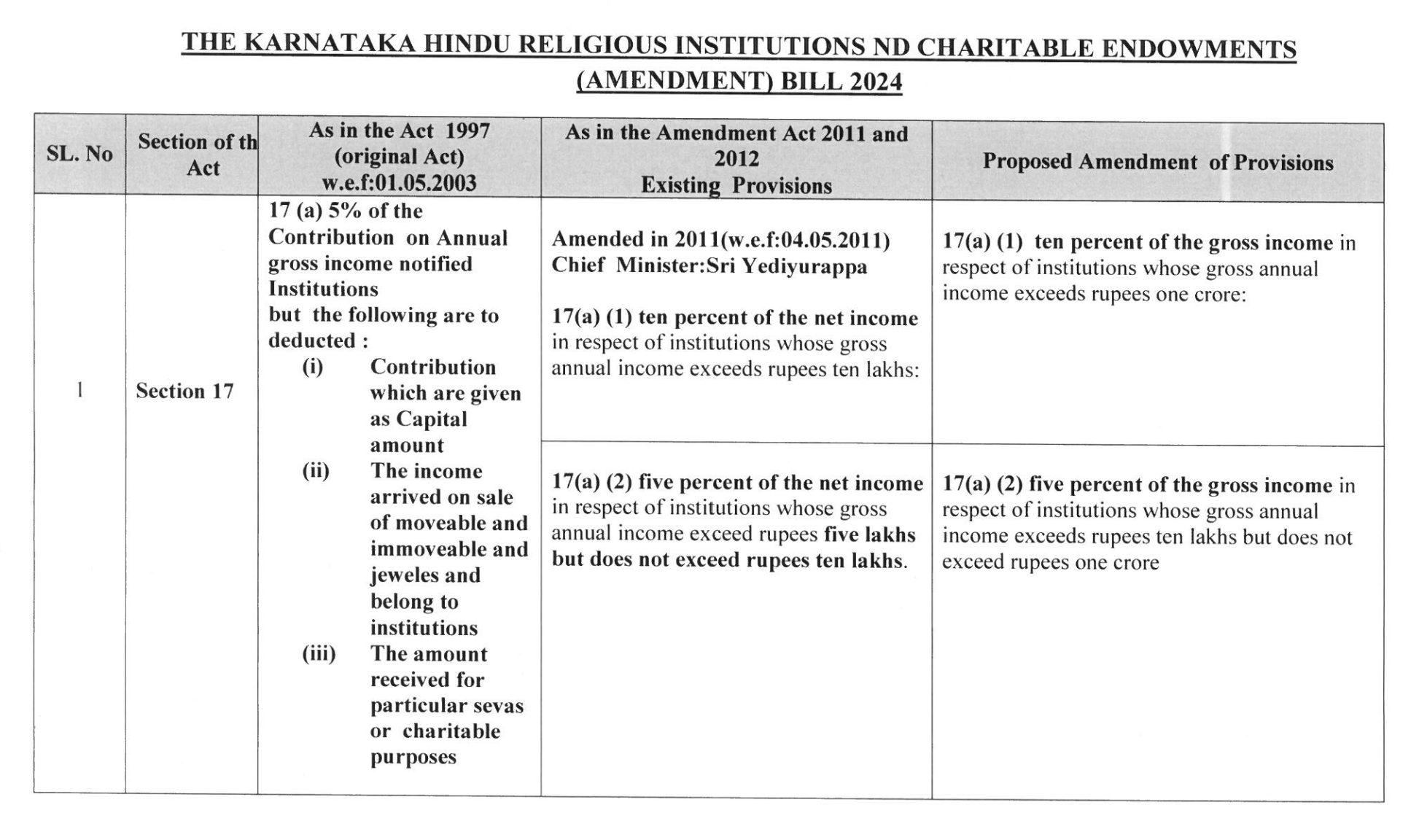

The Karnataka Hindu Religious Institutions and Charitable Endowments (Amendment) Bill, 2011

The Karnataka Hindu Religious Institutions and Charitable Endowments Amendment Bill 2011 proposed changes to enhance transparency, streamline administration, and ensure better management of temple trusts and assets. It sought to address issues related to governance, financial management, and accountability within these institutions. Additionally, the bill aimed to strengthen the regulation of temple properties and endowments to prevent misuse and promote the effective utilization of resources for religious, charitable, and welfare purposes. The legislative amendments were intended to modernize and improve the functioning of these institutions.

The Karnataka Hindu Religious Institutions and Charitable Endowments (Amendment) Bill, 2024

The Purpose of the Amendment

The core purpose behind the proposed amendment was twofold. Firstly, it aimed to create a more robust support mechanism for ‘C’ category Hindu temples, which represent the smaller, often rural, temples struggling with financial constraints. Unlike their wealthier counterparts, these temples face significant challenges in maintenance and conducting regular religious services due to limited income streams. Secondly, the amendment sought to enhance the welfare of priests serving in these temples by ensuring a more equitable distribution of resources. By proposing a redistribution of income from wealthier temples, the government intended to establish a financial lifeline for the less fortunate temples, thereby fostering a more unified and supportive Hindu religious community in Karnataka.

Key Provisions in the Amendment

At the heart

of the Karnataka Hindu Religious Institutions and Charitable Endowments

(Amendment) Bill, 2024, were several key provisions aimed at restructuring the

economic framework within which Hindu temples in Karnataka operate. The

amendment proposed the collection of a specified percentage of income from

temples with annual earnings exceeding Rs 10 lakh. This collected amount would

then be funneled into a Common Pool Fund, designed to serve multiple purposes -

from maintenance and renovation of ‘C’ category temples to providing financial

assistance and scholarships to priests and temple staff.

What is the Common Pool Fund?

The Common Pool Fund is extensively outlined in Chapter 4 of

the Hindu Religious Institutions and Charitable Endowments Act, 1997. The State

Dharmarika Parishad is authorized to establish a common pool fund. This fund

collects a portion of the revenue from major temples and state government

grants to support the upkeep of smaller and financially challenged Hindu

temples and religious institutions under the Muzrai department. Grants are

allocated for various purposes such as establishing Hindu orphanages,

constructing cowsheds, and promoting the study of Hinduism, among others.

Another

significant provision within the amendment was the establishment of clear

guidelines for the allocation of funds from this Common Pool. It emphasized

that the usage of funds must be strictly limited to Hindu religious purposes,

addressing concerns about potential misuse for non-religious activities. This

specification was a response to opposition allegations and sought to clarify

the government’s stance on maintaining religious sanctity and purpose in the

distribution of temple revenues.

By

introducing these provisions, the Karnataka Hindu Religious Institutions and

Charitable Endowments (Amendment) Bill, 2024, aimed to bring about a more

equitable system of financial support within the Hindu religious community in

the state, ensuring that all temples, regardless of their income, could fulfill

their religious and cultural responsibilities.

Arguments Against the Amendment

Opponents of

the amendment argued that allocating a percentage of income from wealthier

temples to a Common Pool Fund would undermine the financial autonomy of these

institutions. They expressed fears that the redistribution could lead to

government overreach and misuse of funds intended for religious purposes.

Moreover, detractors highlighted that temples, as entities deeply rooted in

faith and community, should not be treated as mere revenue sources. The

significant resistance in the Legislative Council, where the proposed

amendments were ultimately rejected in a voice vote, underscores the divisive

nature of the bill and the complexities involved in managing religious

endowments.

Potential Outcomes for Religious Institutions

One of the

core objectives of the amendment bill is to ensure a more equitable

distribution of resources across Hindu temples, particularly benefiting those

in the ‘C’ category who are less financially endowed. If successfully

implemented, this could mean an upliftment in the maintenance and activities of

smaller temples, potentially increasing their relevance and attendance within

their communities. Such a shift not only promises better facilities and more

robust religious programs but could also strengthen community ties and

reinforce the importance of lesser-known temples in Karnataka’s cultural and

spiritual landscape.

Additionally,

the focus on priests’ welfare and temple upkeep through the generation of a

Common Pool Fund might lead to a heightened sense of security among temple

caretakers and priests. This, in turn, could attract more individuals to take

on these roles, knowing that there is a systemic support network backing their

welfare and that of the temples they serve.

The Road Ahead for the Amendment Bill

The future

of the amendment bill seems uncertain after facing challenges in the

Legislative Council but passing in the Legislative Assembly. Opposition from

parties like BJP and JD(S) due to concerns about religious tensions and fund

misuse highlights the need for careful discussion and possibly changing some

parts of the bill. The bill's fate might depend on the results of the upcoming

Lok Sabha elections, which could change how the law is handled. Involving

temple authorities, priests, and community members could help find common

ground or adjust the bill to address concerns. The decisions made in the next

few months could influence how similar laws are handled not just in Karnataka,

but in other states too.

Future Implications and Conclusion

The

Karnataka Hindu Religious Institutions and Charitable Endowments (Amendment)

Bill, 2024, has stirred a notable controversy, not just for its immediate

impact but also for the potential long-term effects it could have on religious

institutions and the socio-political landscape of Karnataka. This piece delves

into the future implications of the amendment, offers insights into what lies

ahead for the proposed legislation, and provides some final thoughts on the

matter.

Comments

Post a Comment